Now let me answer a very important question for all of you and the question is what is the importance of SGX NIFTY for an Indian trader? As you can see here, investors can trade in SGX NIFTY day and night with very few interruptions and that is probably one of the reasons why it is so popular outside of India. In contrast to the Indian markets that are open for just about six hours, the Singapore stock exchange is practically open 24 X 7 and specifically speaking, the trading happens in SGX in these two-time slots. The next very commonly asked question, is What is the market timing for SGX NIFTY? However, if you are an NRI, there is a possibility that you can trade the SGX NIFTY and will depend on the laws of the country that you are living in. If you live in India, you cannot trade any derivatives outside India and that is the law. If you’re an Indian resident, you cannot trade the SGX NIFTY.

Now the next question is very interesting and very commonly asked. However, the accuracy of prices that you will find on is uncanny and the data is synced up pretty much all the time and so you should stick with. For example, you can go to the Singapore stock exchange website, or you can go to other websites like. The best source for tracking SGX NIFTY and its prices is. The first one is how do I track SGX NIFTY. Now that we understand what SGX is, let’s answer some commonly asked questions about it. To protect their portfolio against some unlikely events, they create hedging positions in SGX NIFTY, especially during the hours when our Indian markets are closed.Īpart from these two, I’m sure there are other reasons for trading in SGX NIFTY, but these are the two primary ones. See what happens are the mutual funds of many countries have significant portfolios in India because India is a growing economy. The second are these foreign institutions that have investments in India. Therefore SGX NIFTY becomes a great alternative for them. So those traders who live outside India, they cannot trade 50-50 on NSE. The first are those traders who live outside India and because of international regulations, it is almost impossible to trade derivatives in any other country besides your own. So there are two types of investors or traders for whom it makes sense to trade SGX NIFTY. Well, what is going on here? Why is a NIFTY contract trading on Singapore stock? After all, if someone wants to trade NIFTY, why won’t they just it on NSE? Why go all the way to Singapore for that? So similar to how we trade NIFTY 50 futures in the Indian stock exchange, foreign investors can trade SGX NIFTY on the Singapore stock exchange. So SGX NIFTY is a futures contract that is traded on the Singapore Stock Exchange. So when you put them back together, it makes sense. Well, we will answer all these questions in this article.įirst of all, let us break these two terms down: SGX refers to Singapore Stock Exchange and NIFTY refers to our own NIFTY 50 indexes. So what exactly is SGX NIFTY? What is its importance? Is that something we can read? Should we keep track of that while we are trading? So most of the beginners feel puzzled listening to such comments because they don’t understand what SGX NIFTY is.

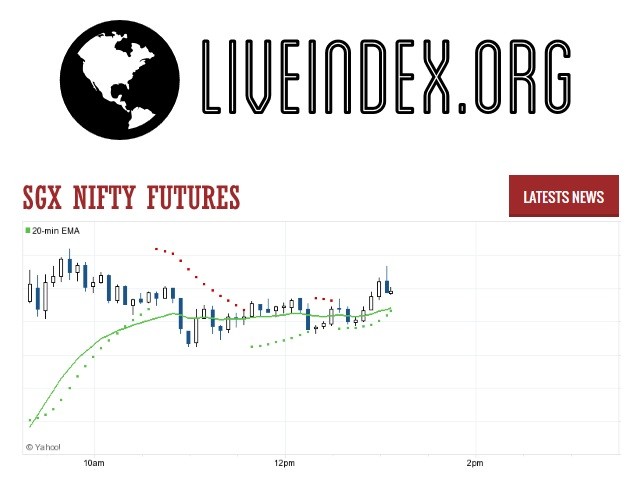

If you listen to any business news channel in the morning, you would have noticed the news anchors talking about how SGX NIFTY is indicating a gap up or gap down of 20 points, 50 points or even a hundred points. In this session, we will understand everything that is there to know about SGX NIFTY.

0 kommentar(er)

0 kommentar(er)